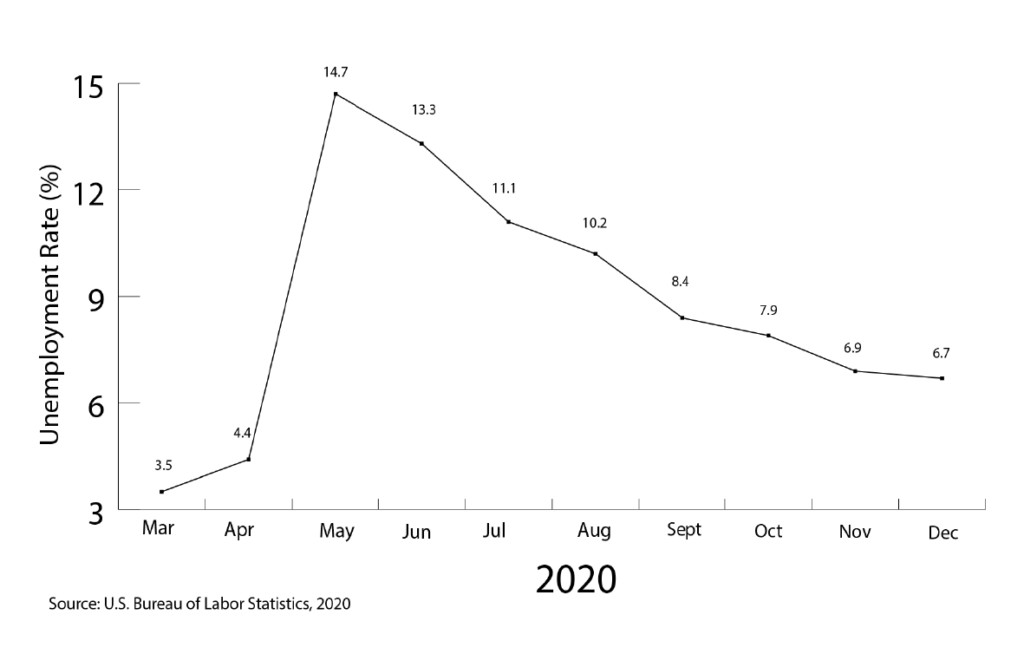

2020 came and went, but it left behind a financial mess for many Americans to recover from.

2020 unemployment statistics show that between March and May, nearly 16 million Americans lost their jobs, and many of those who filed for unemployment had to use additional means to carry on.

Thirty-nine million also reported using their stimulus payment as a primary revenue source to pay for necessities. A similar 41 million reported surviving on their regular income.

In light of this information, James Murphy, a financial planner from harvest financial in Omaha offered some blanket advice for preparing your finances in case this happens again.

“Cut out the noise, automate as many things in your life as you can so that you’re not having to babysit every little piece of your life,” Murphy said.

Murphy said he highly encourages removing any debt you may have, first and foremost. He said in his observation, it’s difficult to cut through all the clutter of everyday life and focus on your finances, but COVID-19 has allowed people more time to do so.

“Carefully consider your finances,” he said. “There are some really great apps that assist with budgeting so you don’t have to recreate the wheel and come up with your own budgeting system.”

As things do start to slowly recover, it is important to remember that healing will take time, but Murphy hopes that this will provide people and impetus to pursue new opportunities and better financial stewardship.

“There’s still great opportunity in America, so that would be my message to everybody, to look for the opportunity and take advantage of that,” he said.